Irs 24 Hour Customer Service Line

Our Tools page has additional self-service options. So after first choosing your language then do NOT choose Option 1 refund info.

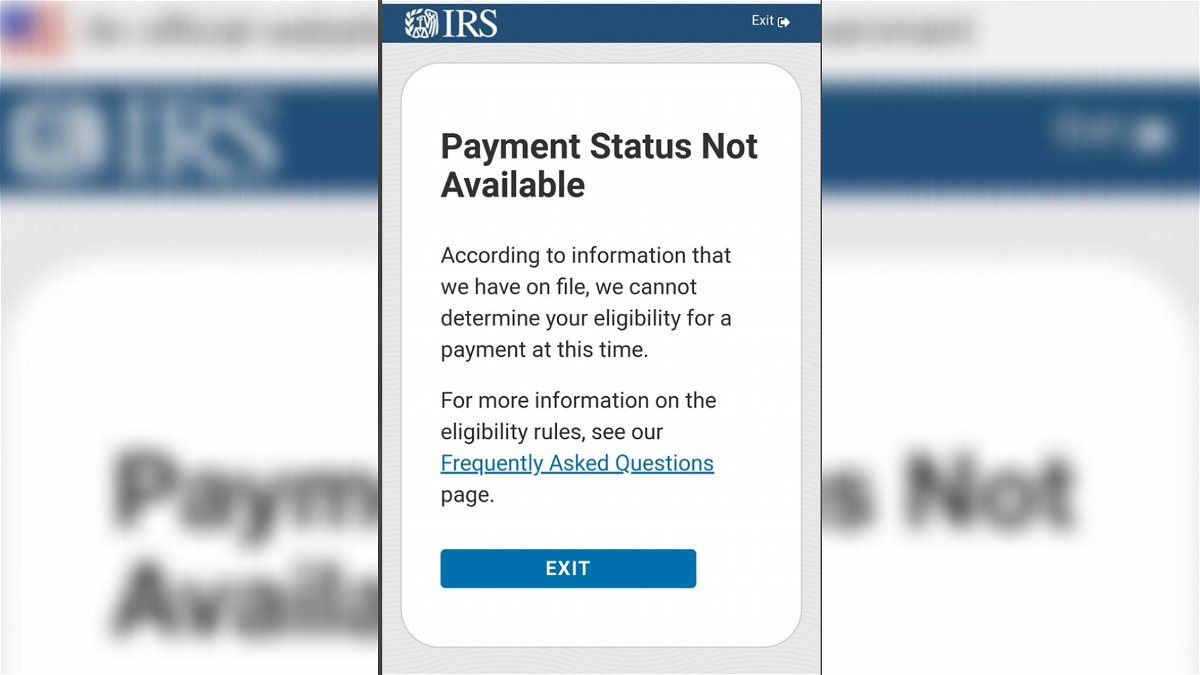

People Say They Can T Find Their Stimulus Check Using The Irs Payment Tracker Krdo

People Say They Can T Find Their Stimulus Check Using The Irs Payment Tracker Krdo

The IRS Help Line is available from 7 am.

Irs 24 hour customer service line. When calling the IRS do NOT choose the first option re. Local time Alaska Hawaii follow Pacific Time. The customer service department is open 24 hours a day 7 days a week.

Monday through Friday from 700 am. Make an Appointment Taxpayer Assistance Centers operate by appointment. If you need help in a language that isnt English our telephone interpreters will help you.

Copies of forms publications and other helpful information are also available around-the-clock at the IRS Web site at wwwirsgov. Request for Taxpayer Identification Number TIN and Certification. After 4 hours of telephoning every number that I can locate numerous each referred me via recording to irsgov.

The best times to call during April are before 1000 am and Monday is the heaviest traffic day. IRS customer service representatives are available Monday through Friday 7 am. The IRS offers several free phone services to taxpayers.

When you arrive wear a mask and stay 6 feet away from others. IRS Hours of Telephone Service. You can also contact your local office during regular business hours.

Read FAQs ask a question in our AnswerXchange community or give us a call. Local time unless otherwise noted. 8 00-829-1040 For individual and joint filers who need procedural or tax law information and or help to file their 1040-type IRS Tax Help Line for individual returns including Individuals Schedules C and E.

Customer Service and Human Help The main IRS phone number is 800-829-1040 but these other IRS phone numbers could also get you the help you need. Contacting IRS to- Verify Business Hours Phone Number. 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday.

These Frequently Asked Questions and Answers for Individuals and Tax Topics also give you instant access to a variety of tax information. The Information Reporting Program Centralized Customer Service Site Telephone 866 455-7438 TOLL FREE 304 263-8700 not toll free Hours 830 am to 430 pm Monday through Friday ET. Individual Tax Return Form 1040 Instructions.

Notice you may have received. Our customer service representatives are available Monday through Friday 7 am. Instructions for Form 1040 Form W-9.

IRS TEGE Customer Service You may direct technical and procedural questions concerning charities and other nonprofit organizations including questions about your tax-exempt status and tax liability to the IRS Tax Exempt and Government Entities Customer Account Services at 877 829-5500 toll-free number. The IRS provides a few toll-free numbers to assist you depending on your circumstance. You can talk to a customer service representative check your tax refund or take advantage of the TeleTax system to learn about a number of tax topics.

Internal Revenue Service Phone Numbers. I am NOT able to rate Customer Service at this time. Reschedule your appointment if you feel ill.

If you need to contact the IRS the best way to reach an agent is to call the agencys Help Line. Customer service sucks I been on this dang blasted phone 2 hours keep transferring me to different ppl I guest they keep transferring me until its closing time then they can say were unable to answer ur call we are closed for the day but I bet each worker their getting their taxes done fast and getting their refunds fast. Choose option 2 for personal income tax instead.

We have high call volumes and encourage you to review these hot topics for faster service. To visit your local Taxpayer Assistance Center you must. Get all the help you need with TurboTax Support.

IRS Tax Support Phone Numbers. 800-829-1040 for individuals who have questions about anything related to personal taxes available from 7 am. Tina Orem February 5 2021 Many.

This website doesnt address the issue that I need assistance with at all. There are several ways for getting tax information on our website. Refund or it will send you to an automated phone line.

You can contact the customer service department by calling 1-800-829-8374. Available 24 hours a day seven days a week. Our Interactive Tax Assistant tool takes you through a series of questions and gives you immediate responses to many tax law questions.

Many of these services are available 24 hours a day seven days a week. You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day. Local time 800-829-4933 for businesses with tax-related questions available from 7 am.

Https Www Irs Gov Pub Irs Pdf P1239 Pdf

Irs Get My Payment Tool To Track Your Stimulus Payment Is Now Live Wgn Tv

Irs Get My Payment Tool To Track Your Stimulus Payment Is Now Live Wgn Tv

If You Re Looking For A Los Angeles Tax Attorney You Are Most Likely Having Trouble With The Irs Tax Attorney Tax Lawyer Irs

If You Re Looking For A Los Angeles Tax Attorney You Are Most Likely Having Trouble With The Irs Tax Attorney Tax Lawyer Irs

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Co Confirmation Letter Doctors Note Template Letter Of Employment

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Co Confirmation Letter Doctors Note Template Letter Of Employment

Tax Season Today For January 31 2020 In 2020 Tax Season Estimated Tax Payments Income Tax Return

Tax Season Today For January 31 2020 In 2020 Tax Season Estimated Tax Payments Income Tax Return

New 1040 Tax Forms Income Tax Tax Return

New 1040 Tax Forms Income Tax Tax Return

Common Irs Where S My Refund Questions And Errors

Common Irs Where S My Refund Questions And Errors

Instructions For Form 1040 Nr 2020 Internal Revenue Service

Instructions For Form 1040 Nr 2020 Internal Revenue Service

50 Fake Irs Letter In Mail Fu1l

50 Fake Irs Letter In Mail Fu1l

1040 2017 Internal Revenue Service Worksheets Educational Worksheets Reading Worksheets

1040 2017 Internal Revenue Service Worksheets Educational Worksheets Reading Worksheets

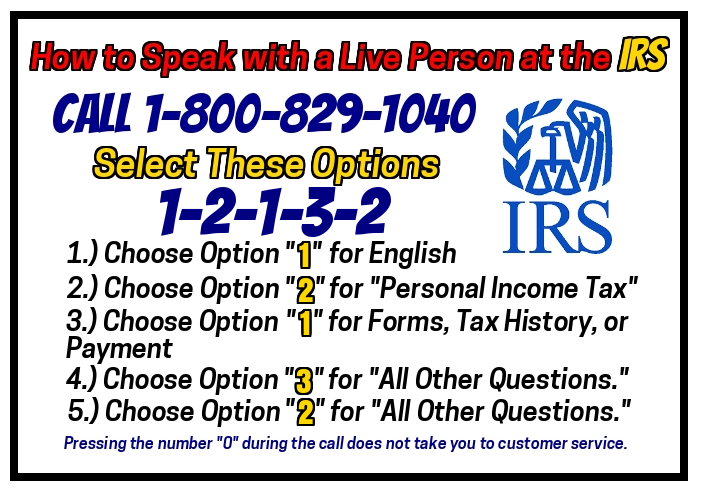

How Do I Speak With A Real Person At The Irs Refundtalk Com

How Do I Speak With A Real Person At The Irs Refundtalk Com

Irs Manual 21 7 13 3 2 2 2 Definition Of Infant S Decedant Definitions Irs Manual

Irs Manual 21 7 13 3 2 2 2 Definition Of Infant S Decedant Definitions Irs Manual

2020 To 2021 Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund Aving To Invest

2020 To 2021 Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund Aving To Invest

Chase Bank Irs Refund 9 Chase Bank Cashier S Check Resume Pdf Chase Bank Credit Card App Money Template

Chase Bank Irs Refund 9 Chase Bank Cashier S Check Resume Pdf Chase Bank Credit Card App Money Template

Https Www Irs Gov Pub Irs News Fs 02 03 Pdf

Irs Second Stimulus Get My Payment Status Gmp Tool For Direct Deposit And Update Portal For Non Filers Updates And Latest News Aving To Invest

Irs Second Stimulus Get My Payment Status Gmp Tool For Direct Deposit And Update Portal For Non Filers Updates And Latest News Aving To Invest

Client Required Contractor Details For Irs 1099 Tax Form E Filing Tax Forms 1099 Tax Form Irs Forms

Client Required Contractor Details For Irs 1099 Tax Form E Filing Tax Forms 1099 Tax Form Irs Forms

Post a Comment for "Irs 24 Hour Customer Service Line"