Can Non Chase Customers Use Zelle

Fraudsters are actively trying to exploit Zelle and other payment apps so Clark advises using it only when transacting with a person you know. Using Chase QuickPay Chase customers can send and receive money from friends and family using just the recipients mobile number or email address even if they dont have a Chase account.

Chase Bank Wire Transfer Fees And Instructions

Chase Bank Wire Transfer Fees And Instructions

Based account not including US.

Can non chase customers use zelle. Non-Chase customers can also send and receive money directly through the Zelle app. There are many banks that use Zelle including Wells Fargo US. Bank Citi and Bank of America.

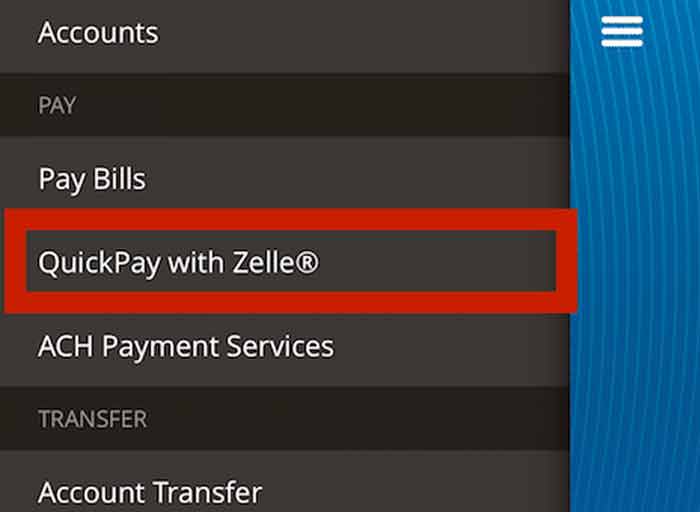

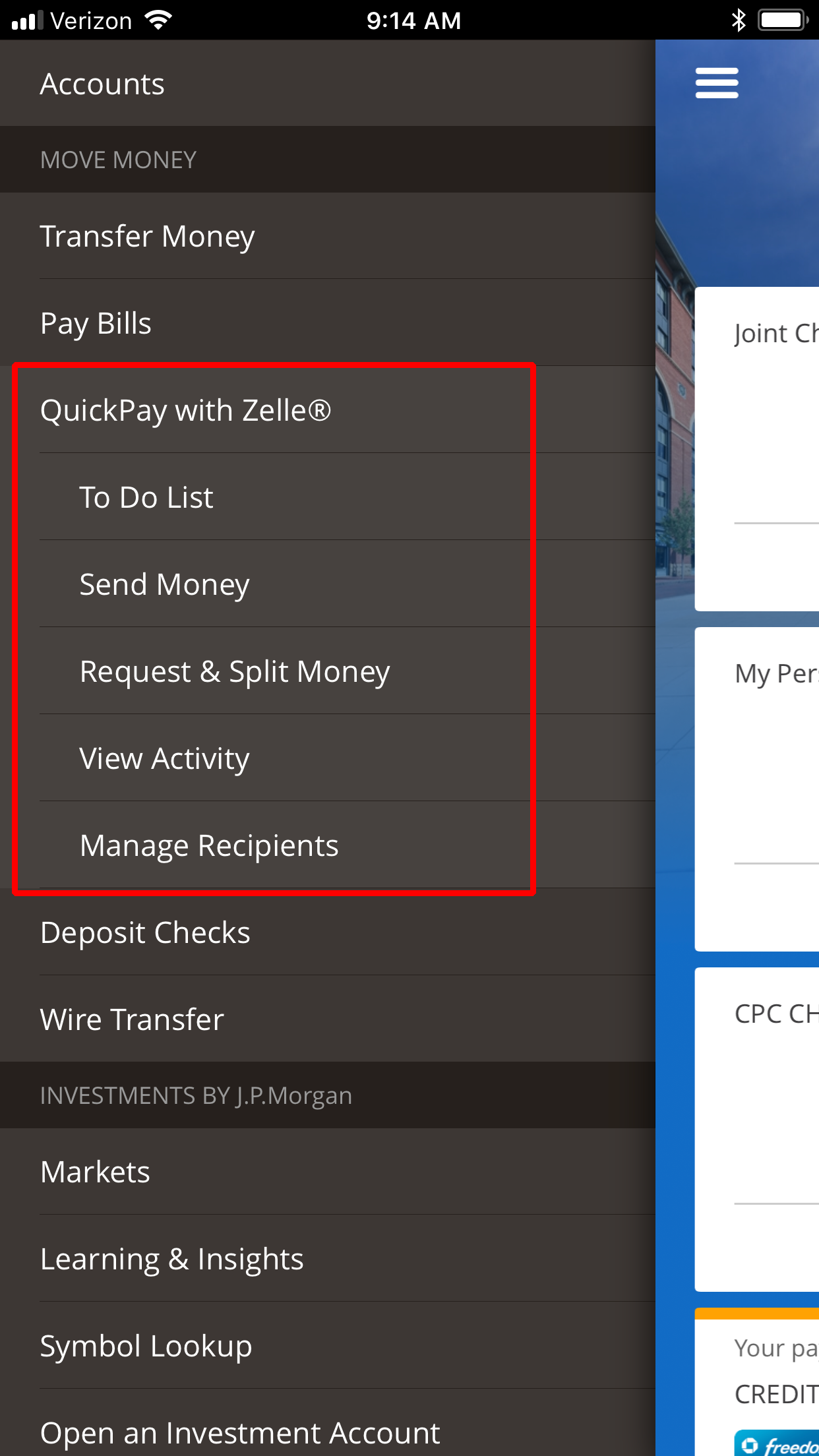

Enrollment in Chase QuickPay with Zelle is required. So contact your bank directly to confirm. In addition to Chase Zelle members include many major US.

You can use Zelle through your online banking service or via the Zelle app to make payments to friends family and people you trust. TerritoriesZelle does not accept debit cards associated with international deposit accounts or any credit cards. Zelle links to a users bank account and allows customers to send money to.

Both parties need a US. Personal Chase checking account and Chase Liquid card 2000 per transaction and day 16000 per calendar month. Only one needs an eligible Chase account.

If you already have Zelle through your bank or credit union follow the steps to enroll and start sending and receiving money. Funds are typically made available in minutes when the recipients email address or US. If your bank or credit union does NOT offer Zelle - The person you want to send money to or receive money from must have access to Zelle through their bank or credit union.

So while you might think this service is limited to Chase customers only its actually not. In order to use Zelle with your business account your bank or credit union must currently offer Zelle for your business account type. To get started search the list below for the bank or credit union where you already have a bank account.

The recipient just needs to have a savings account or checking account at a bank participating in the Zelle network. Zelle is a quick way to pay people you know and trust in minutes. They just need to sign up for person to person payments.

One of the neat things about Chase QuickPay is that you can send and receive money from someone who is not a Chase customer. Enrollment in Chase QuickPay with Zelle is required. 3 No check or cash needed.

The ONLY Safe Way to Use Zelle. You sign up as usual and then take out your debit card and use its details when adding your Bank information into the app. Only one needs an eligible Chase account.

The process is simple. Chase QuickPay with Zelle. Both parties need a US.

Chase QuickPay with Zelle. Please note that not all banks and credit unions offering Zelle to consumers offer Zelle for small businesses. What should I do now so I can continue using Zelle.

If the recipients financial institution does not offer Zelle the recipient can download the Zelle app and enroll with basic contact information an email address and US. For eligible US based customers Zelle can be a fast way to send money to friends and. And banks like Chase have jumped on the bandwagon.

The service is a digital payment network that is pre-built into many banking apps such as Chase Bank and Bank of America. Yet you can use your credit union debit card to sign up with the Zelle app. Easy and convenient Millions of consumers already have access to Zelle through their financial institution so even non-Chase customers can use it.

Funds are typically made available in minutes when the recipients email address or US. In mid-2017 Chase replaced its previous Chase QuickPay app for a new Zelle-powered offering called Chase QuickPay with Zelle. If your bank or credit union offers Zelle - You can send money to almost anyone you know and trust with a bank account in the US.

The Zelle app will soon only be available to users whose banks and credit unions do not offer Zelle directly to their customers. Mobile number and a Visa or Mastercard debit card with a US. When you bank with Chase you can leverage this partnership between Chase and Zelle to quickly and easily transfer money to family and friends for free.

Not at this time. Chase customers now have broader access to an easy safe and fast way to pay other individuals through the Zelle SM network. In fact on the Zelle website it says You can send money to almost anyone you know and trust with a bank account in the US.

If your friends or family do not bank with Chase you can still use Chase QuickPay with them.

Zelle And The Future Of Payments For Community Banks Centerstate Correspondent Bank

Zelle And The Future Of Payments For Community Banks Centerstate Correspondent Bank

How To Transfer Money With Chase Quickpay

How To Transfer Money With Chase Quickpay

Can I Use Zelle To Send Money Internationally No Find Alternatives Now

Can I Use Zelle To Send Money Internationally No Find Alternatives Now

/images/2019/10/10/x_things_to_know_about_chase_quickpay.jpg) How To Use Chase Quickpay And 6 Crucial Things To Know Financebuzz

How To Use Chase Quickpay And 6 Crucial Things To Know Financebuzz

Zelle Fraud Emergency Kit And Faq Bobsullivan Net

Zelle Fraud Emergency Kit And Faq Bobsullivan Net

Consumers And Small Businesses Significantly Increase Use Of Zelle In 1st Half Of 2020

Consumers And Small Businesses Significantly Increase Use Of Zelle In 1st Half Of 2020

Zelle Now Live In Mobile Banking Apps Today A New Way To Pay

Zelle Now Live In Mobile Banking Apps Today A New Way To Pay

Chase Quickpay Everything You Need To Know About Free Money Transfers

Chase Quickpay Everything You Need To Know About Free Money Transfers

Chase Pay Vs Chase Quickpay Complete Guide 2021

Chase Pay Vs Chase Quickpay Complete Guide 2021

Paypal Vs Venmo Vs Zelle Who S The Best Zipbooks

How Do You Use Zelle Valuepenguin

Chase Quickpay With Zelle How To Send Someone Money Youtube

Chase Quickpay With Zelle How To Send Someone Money Youtube

.jpg) Paypal Venmo Or Zelle Which Is Better

Paypal Venmo Or Zelle Which Is Better

Is Zelle For Business Better Than Venmo Here S The Truth

Is Zelle For Business Better Than Venmo Here S The Truth

Help My Chase Account Has Been Hacked With Zelle Quickpay

Help My Chase Account Has Been Hacked With Zelle Quickpay

Zelle How To Use It And What You Should Know Transferwise

Zelle How To Use It And What You Should Know Transferwise

Post a Comment for "Can Non Chase Customers Use Zelle"